Aligned Giants: What Google AP2 and Coinbase x402 Reveal About the Next Phase of AI Payments

Highlights

Opening: Big Tech crowds into AI payments—the real inflection emerges

AI remains the most sleepless battlefield. While the arms race on the model side rages on, a new front—AI payments—is rapidly taking shape.

Stripe has introduced Tempo, its own payment L1. PayPal has invested in Kite.AI. And just yesterday, Google unveiled the open Agent Payments Protocol (AP2) and signaled a collaboration with Coinbase’s x402, integrating it into Google’s A2A framework.

As AI capability matures, the conversation is moving to commercialization. More people now recognize that payment is indispensable for agents—not merely a “feature,” but the basis for agents to become first-class citizens on the Internet. That, in turn, unsettles the foundations of e-commerce operations, advertising/distribution, and Internet finance, and will catalyze a new category altogether: Agentic Commerce.

This article analyzes the latest moves by two giants—Google’s AP2 and Coinbase’s x402—to map the trajectory of AI payments and the opportunities ahead.

01|AP2: Bringing "how AI spends" into a regulated common language

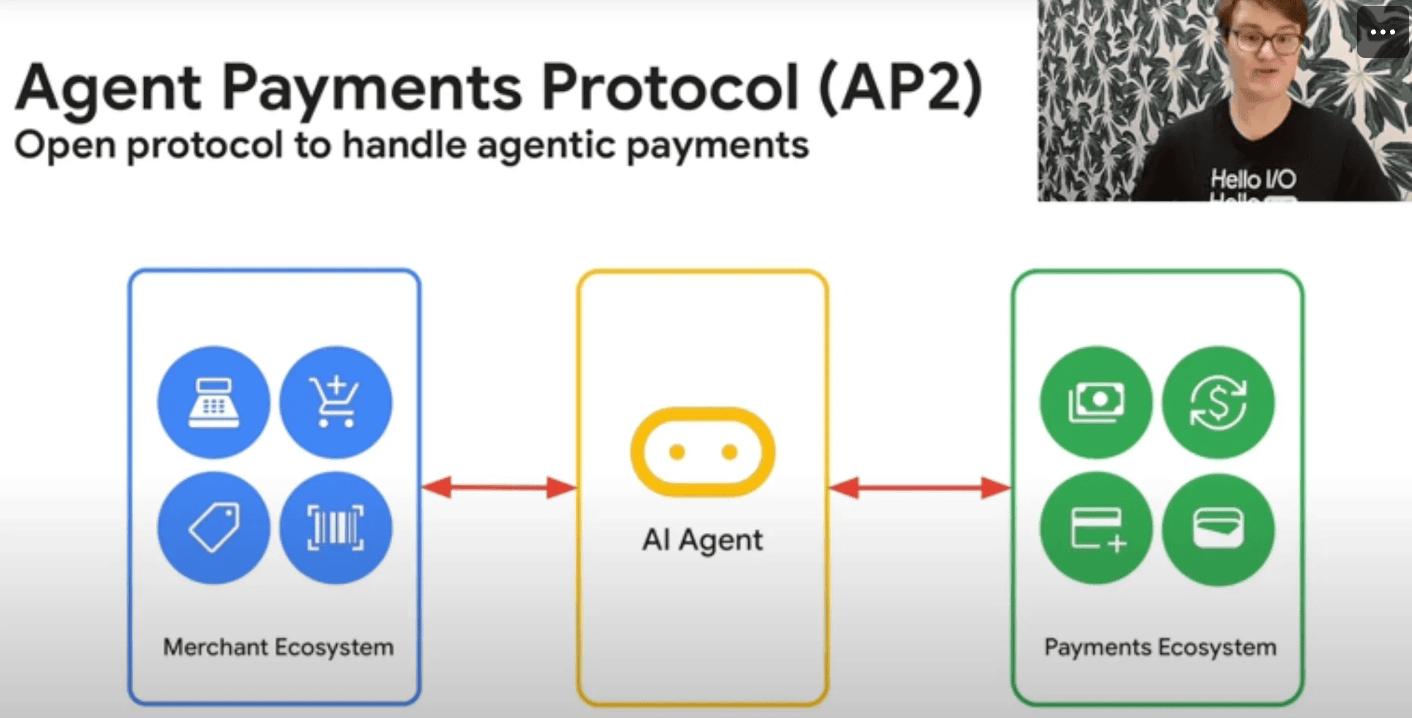

This week Google, together with 60+ payment networks, financial institutions, e-commerce and blockchain companies, announced AP2 (Agent Payments Protocol)—an attempt to lay a common standard for the intersection of AI and payments.

Before AI, “payment” meant a human clicking “Checkout”. Any automated payment was treated as unsafe, and the system evolved deep risk-controls to resist it. In the AI era, however, if an agent is allowed to initiate transactions, three hard questions arise:

Google’s AP2 tackles this head-on: it defines an open protocol standard that provides a common language for secure, compliant transactions between AI and merchants. At its core is a dual-mandate authorization framework among the user, the AI, and the merchant:

Both mandates are cryptographically signed verifiable credentials. Once signed, they form a chain of non-repudiable evidence. For merchants and payment networks, this means the request isn’t from some anonymous bot; it arrives wrapped in a user-authorized, verifiable transaction contract. With AP2’s “transaction contract,” merchants and networks can confidently treat the transaction as legitimate and release it.

AP2 does not modify Visa/ACH/stablecoin rails. It adds, above them, a trust semantics layer—who is spending, on what basis, under what constraints—so that intent confirmation works consistently across fiat and stablecoin rails. In the AI + stablecoin “dark forest,” we need cryptography and process constraints to bring each agent’s actions into order and prevent harm.

Although AP2 is early, Google’s focus is clear: alleviate every participant’s fear that agents will spend out of bounds.That is a precondition for AI to execute payments:

02|x402: Binding payment to service, using stablecoins to build the machine economy

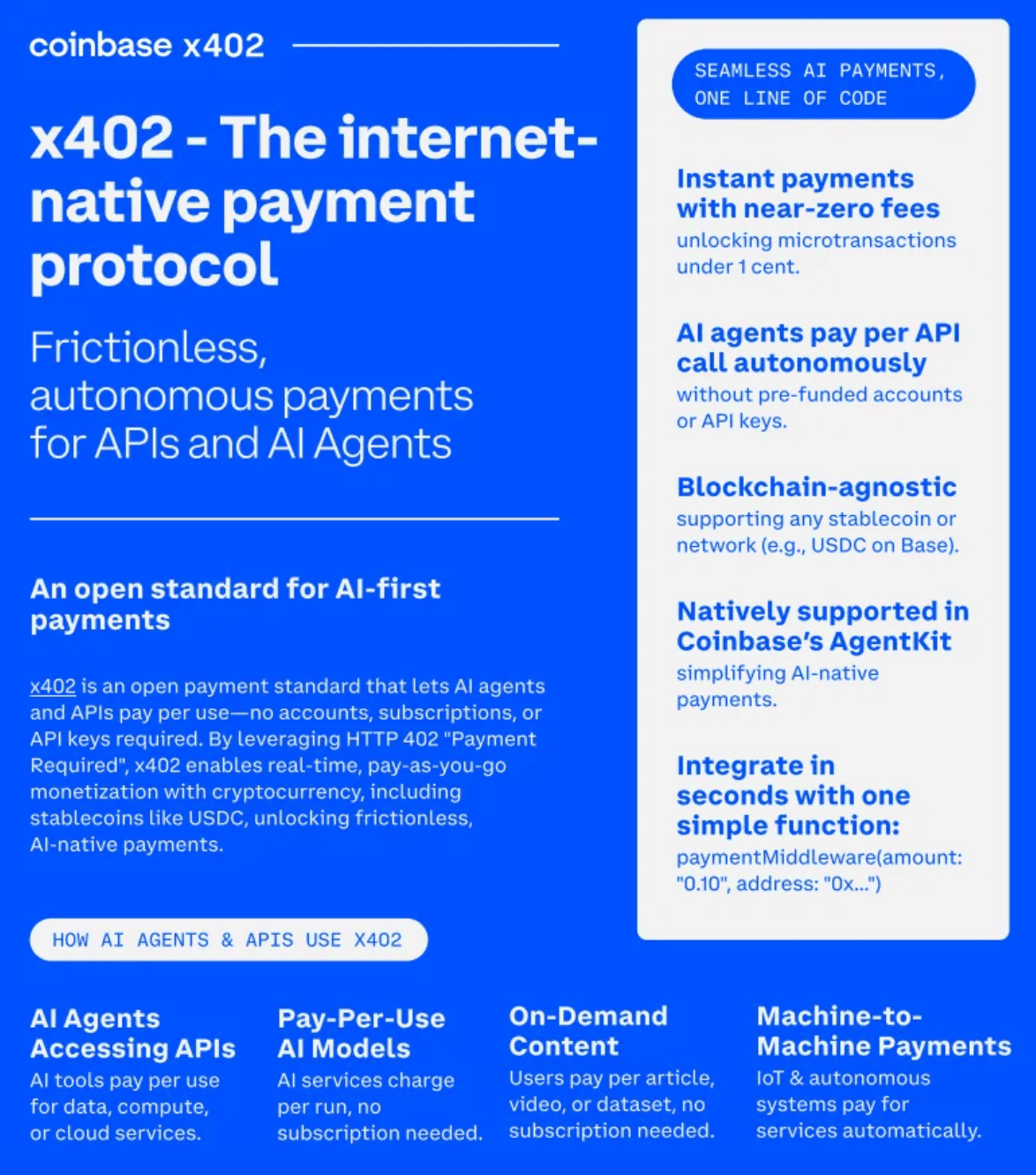

Google is focused on authorization and safety above the clearing rails, while Coinbase—closer to stablecoins and blockchains—goes straight at the transaction itself. With x402, Coinbase aims to make stablecoins the native money and primitive of AI payments, binding payment to consumption at the protocol level.

x402 takes its name from HTTP 402 —a status code that historically saw little standardized use. With AI now accessing more pages and APIs than humans do, a natural question arises: shouldn’t agents pay for access, too?

x402 answers by coupling API access with payment:

When an AI agent calls a service, the server can respond with a 402 quote—a machine-readable “bill.” The agent then settles it—e.g., in USDC—and retries with a receipt; the service immediately unlocks.

Although x402 is a light protocol, not a full product, its fusion of AI with stablecoins sketches a native future for AI payments:

03|Two rails, one destination

If AP2 is the AI extension of traditional payments, x402 wil bethe AI-native payment module of Web3. Together they embody two rails converging toward the same destination: agent-callable payments.

The conclusion is quite obvious here: the next phase of AI payments is dual-rail and interoperable, not either-or.

04|Startup runway: Above the protocol, what's missing is execution

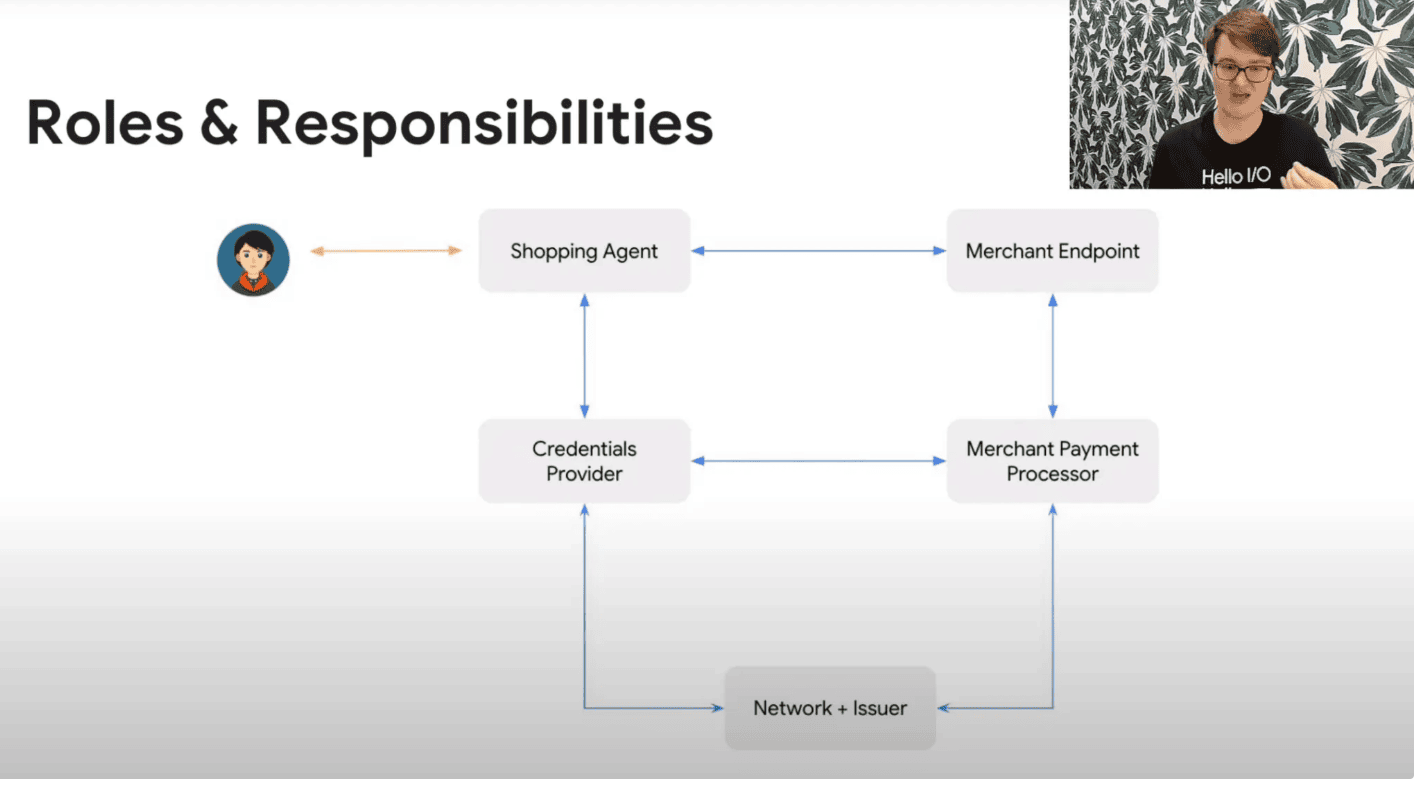

Giants define standards to build ecosystems and influence. But protocols like AP2 and x402 are still far from a turnkey, production-grade AI payments stack. What’s scarce are productized execution components on top of those protocols.

A Google has mapped out the roles and responsibilities involved in agent payments. Protocols like AP2 primarily coordinate the parties in the payment chain to trust AI-agent payment requests via verifiable credentials. But the execution layer of payment product is open to other payment actors—Credentials Providers, Merchant Payment Processors, Networks/Issuers. In the agent era, can AI payment product become the next trillion-dollar market? The pioneers are looking for the answer.

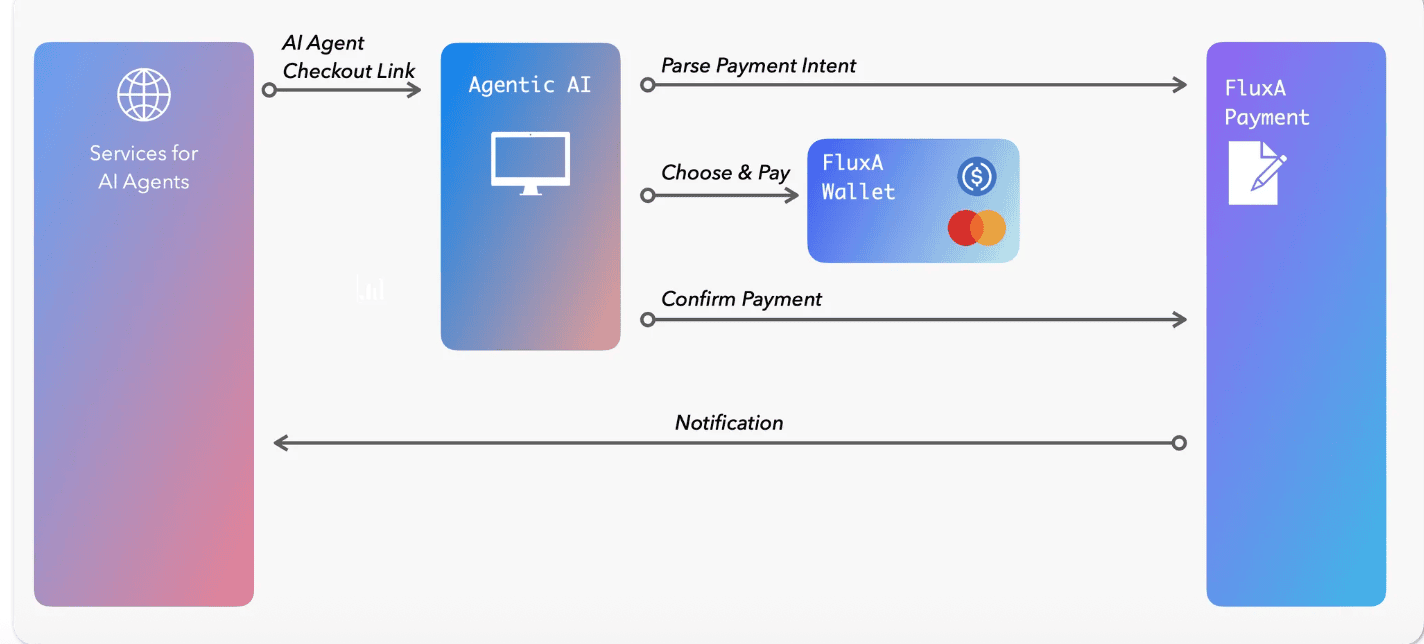

05|FluxA: Building the "mass-production car" above the protocols

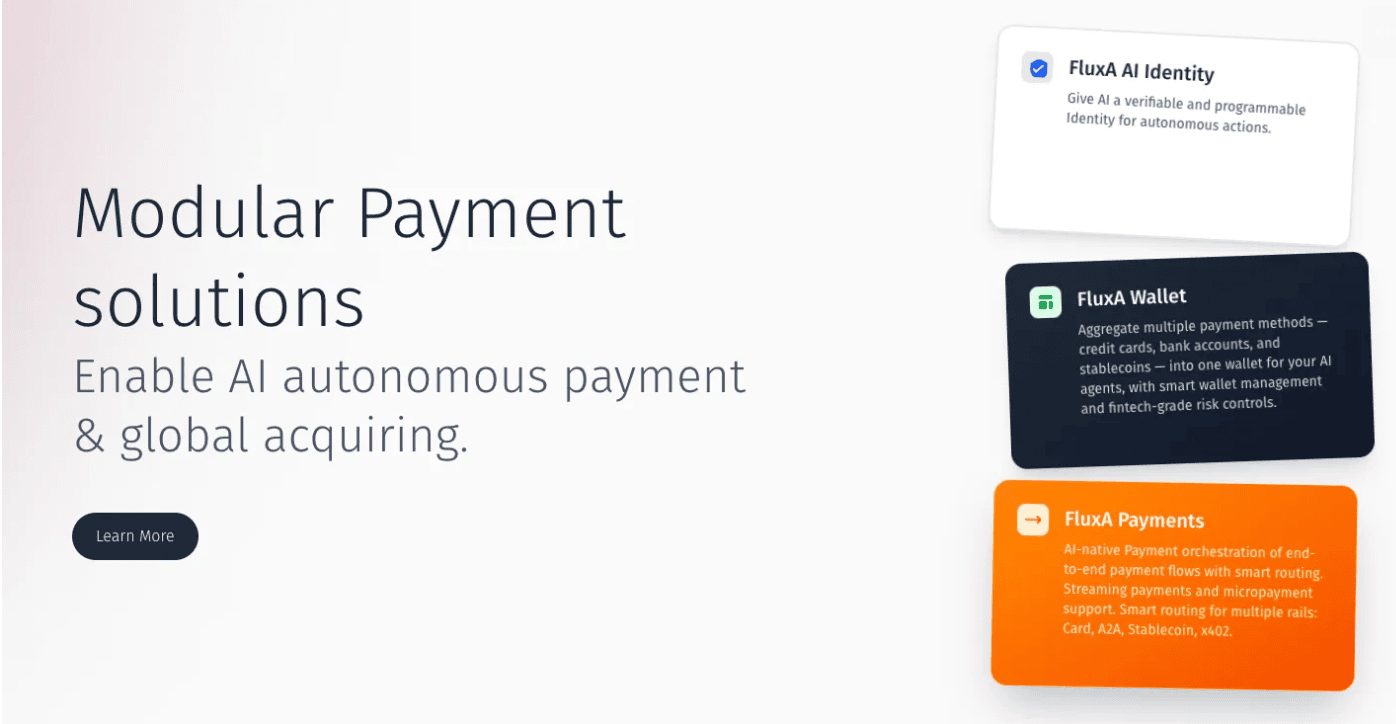

FluxA is an AI-native payment execution layer founded by former Alibaba/Ant Group leaders—now joining the agent-payment race in earnest.

FluxA’s goal is to deliver payment primitives for the agent economy—modular identity, wallet, acquiring, and rails—so developers can assemble agentic economic services like building blocks.

FluxA covers four indispensable rings for agent payments:

If Google AP2 and Coinbase x402 are the highways, FluxA aims to ship the first mass-production cars on them:

In early innovation cycles, startups often move faster than giants. Open protocols are just leaving the gate; truly usable products remain scarce. Enterprises want agents to pay quickly, but not chaotically—they need compliant, auditable middle platforms. Developers don’t want to hand-integrate dozens of gateways and wallets; they want a one-stop abstraction so payments feel like calling an API.

FluxA won’t reinvent protocols; it will align deeply with AP2/x402 and prioritize integration with major processors and wallet ecosystems. FluxA’s value is conversion: turning standards into usable product, and defaulting security requirements into the configuration baseline. Giants build the highway; startups ship the cars.

Ecosystem complementarity, not rivalry:

Conclusion: From talking to transacting—the real AI economy starts

With Google and Coinbase pushing standards on parallel rails, the market needs less slogan and more execution. AP2 brings trust and compliance; x402 unlocks instant, programmable settlement; FluxA turns those abstractions into callable payment primitives.

The next phase of AI payments will be co-defined by standards and execution layers. Agents need delegated authority—and verifiable accountability. Payment isn’t just a transfer; it must be orchestrated, observable, and extensible. For developers, the ideal is shipping AI pay/collect in days, not months.

The inflection is here. FluxA aims to work with partners to move the agent economy from papers and demos to reliable, usable, and scalable reality.